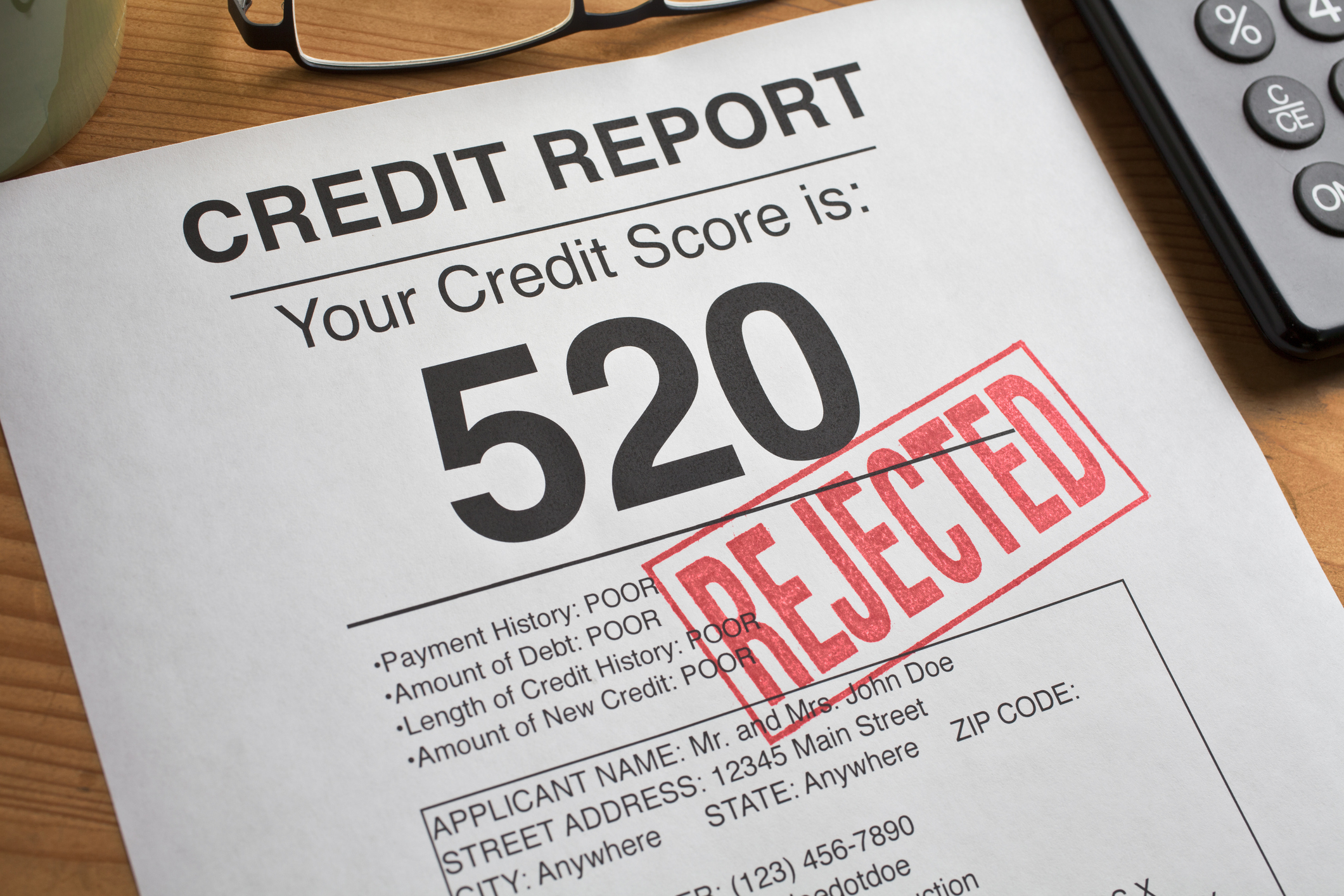

You should understand that restoring and rebuilding your credit takes time and patience and can be very frustrating; however, the benefits can affect your entire life. Did you know that your bad credit could keep your from getting a job? In today’s tough economic times, bad credit affects more than your ability to get loans. It could keep you from getting a job. You should diligently monitor your credit and make sure to dispute anything that is incorrect. Oftentimes, the information on your credit report is wrong; however, if you do not file a dispute, it will stay there for a very long time.

If the get credit repair company you’re interested in tells you they have secrets which can help them work harder for you than any other company, they’re lying. There are no secrets which can help anyone work on their credit repair any faster than anyone else. I wouldn’t trust anyone who lied to me!

The client feedback in the form of testimonials will help you understand about the company better. Check about the authorization of the company. Also see whether the company is properly affiliated. If possible, check with the clients directly about the company and get to know their firsthand feedback. These factors will enable you to get in touch with a legally authorized settlement company. This will lead you to legally eliminate debt.

Getting a job, yes with most employers that are hiring. They do run a Consolidated credit solutions report on you when applying for employment and can hinder you from getting the job. Employers want to know that the employee that they are hiring will be responsible in assisting running their company as well. They look at it as though, if you can not control your own finances how can they trust you with their business.

If you have a mortgage, car loan, or even utility payments, keep those payments current and pay them on time. Most of the time, these payments are reported on your credit report and if you keep them current and on time they will be reported to the credit reporting bureaus and will help rebuild your credit score.

Stay on top of your credit. Try to get your credit report and score on a frequent basis, including through sites that provide a free online score. These offers usually come with a trial offer for an identity monitoring service. Closely monitoring your credit score will alert you to fluctuations in your credit profile that might indicate incorrect information on your credit report or possible identity theft.

After making your payments, on time, for 5 or 6 months; you want to ask for a credit limit increase. More than likely the credit card companies will give you a higher limit. By following these tips over time, you will have established your credit by the time you are 18, so you can buy your first car with a good interest rate and terms.